Payment and performance bonds ensure that project owners and stakeholders are protected during the construction process. Learn the difference between payment vs performance bonds and how they work together on public contracts.

Understanding Payment vs Performance Bonds

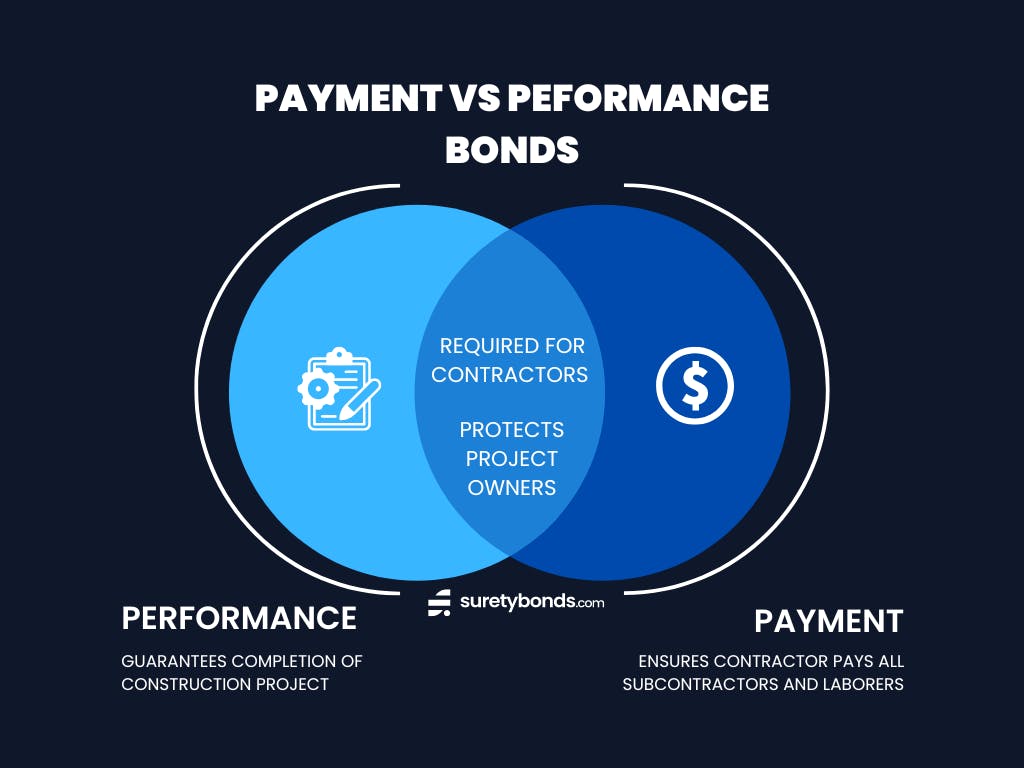

Payment and performance bonds are both types of construction bonds that guarantee contract fulfillment. They often go hand-in-hand, but serve different purposes.

What's a performance bond?

A performance bond is a guarantee that a contractor will complete a project according to all contract terms.

What’s a payment bond?

A payment bond ensures that a primary contractor will pay subcontractors and material suppliers in full and on time.

How Do Payment and Performance Bonds Work Together?

Together, payment and performance bonds ensure large construction projects are completed appropriately and all parties involved are properly compensated. Both bond types create a legal agreement between three parties:

- Principal: The contractor filing the bond

- Surety: The surety company issuing the bond

- Obligee: Project owner/government agency requiring the bond

When Do You Need a Payment Bond vs Performance Bond?

Payment and performance bonds are almost always issued together. Most large public construction projects require contractors to get both a performance and payment bond. However, some contracts for private or smaller public projects will only mandate a performance bond.

While typically purchased together, you can buy payment and performance bonds at separate times. A payment bond can be purchased while negotiating a contract, and performance bonds are necessary before breaking ground.

Miller Act Payment and Performance Bonds for Public Construction Projects

The Federal Miller Act requires contractors to get performance and payment bonds for all publicly-owned construction projects over $100,000. Certain states and municipalities also require payment and performance bonds on smaller projects. These bonds protect taxpayer dollars from being lost in failed public construction projects.

How to Get a Performance or Payment Bond

Choosing SuretyBonds.com is the quickest and easiest way to get a payment or performance bond. Just follow these four steps:

- Step 1: Apply for your bond online

- Step 2: Provide any additional information as needed

- Step 3: Pay for your invoice online or over the phone

- Step 4: File the bond form with the project owner

We’re here to help streamline your bond process. Get your free quote now!

Secure | No Obligation | Takes 2 Minutes

How Fast Can You Get Your Payment or Performance Bond?

You can get payment and performance bonds under $750,000 in as little as 24 hours. For bonds over $750,000, the approval process can take anywhere from 3 to 10 days. The timeframe for application approval depends on how quickly you can provide supporting documents and information for the surety to review.

Apply online today and an account manager will contact you within one business day or less!

How Much Do Payment vs Performance Bonds Cost?

Performance and payment bond premium rates typically cost 3% of the total project value. When issued together, you'll only need to pay one premium for both bonds. For example, a qualified contractor would pay $3,000 for payment and performance bond coverage on a $100,000 construction project. Use our Contractor Bond Cost Calculator to get a price estimate today.

Qualifying for Payment and Performance Bonds

Payment and performance bonds require applicants to go through the underwriting process. To complete your application, you may need to provide some additional information:

- Have you ever been bonded before?

- How long has your company existed?

- Project size and contract terms

- Bond coverage amount

- Personal credit score

- Financial credentials

- Work history

A 700+ credit score and multiple years of experience are typically required to qualify for standard payment and performance bonds. If you're a newer contractor or have low credit, call to discuss your options with a surety expert.

Am I Eligible for an SBA Contract Bond?

SuretyBonds.com is an approved partner with the Small Business Association (SBA) surety bond guarantee program. Through this program, the SBA backs the payment or performance bond and guarantees that any claims made on the bond will be paid back. This way, contractors who wouldn't otherwise qualify can get approved for the payment and performance bonds they need.

Learn more about how to get an SBA guarantee bond with us!